Larry McDonald, founder of “The Bear Traps Report” appeared on Friday’s CNBC’s Squawk Box after Silicon Valley Bank was shut down by regulators in the biggest bank failure since the 2008 liquidity crisis.

Silicon Valley Bank reportedly holds $173 billion in deposits.

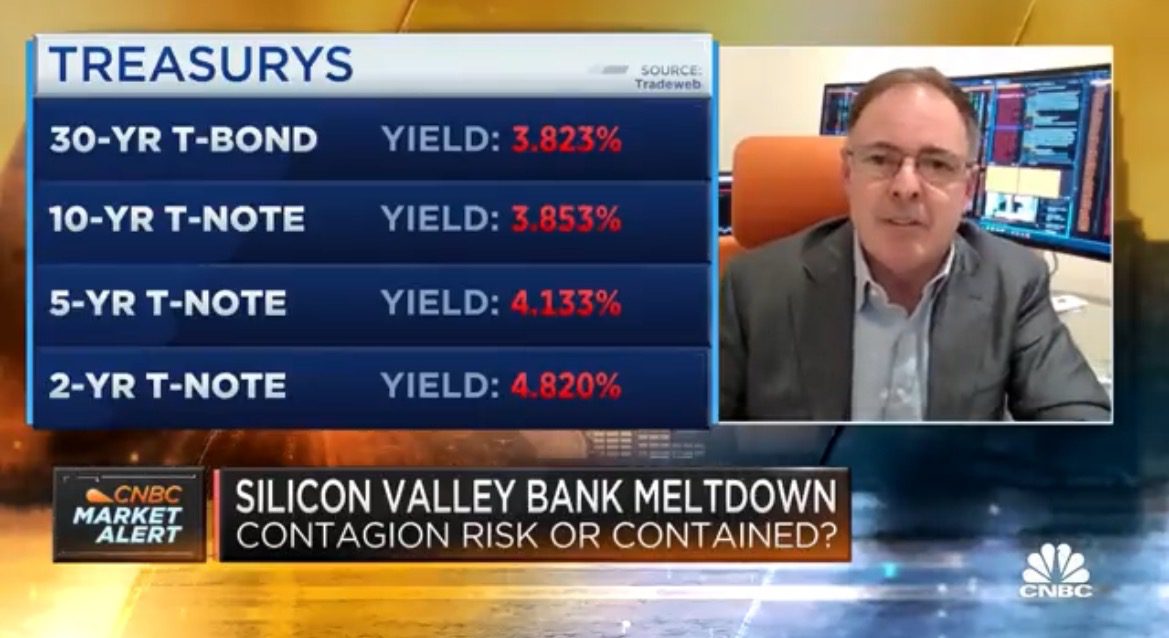

The Fed interest rate is at 4.57% and $117 billion of Silicon Valley Bank securities are yielding only 1.56-1.66% – this is causing a run on the bank.

California regulators shut down the bank and the FDIC took over.

Larry McDonald told CNBC viewers the Federal Reserve is causing the bank run. He predicted the Fed will slash rates by 100 basis points – or 1% – by December to prevent contagion.

The Federal Reserve raised interest seven times in 2022 in an effort to get inflation under control.

2022’s rate hikes totaling 450 basis points is causing problems for bankers because investors want to move their money into higher-yield bonds.

“The Federal Reserve is causing this bank run,” McDonald said. “They need to get inflation down so they’re playing with Frankenstein. This is a contagion process. They’re now probably going to cut rates by 100 basis points by December.”

Fed Reserve Chairman Jerome Powell however this week said another rate hike is on the horizon.

VIDEO:

“The @federalreserve is causing this bank run,” says @BearTrapsReport Larry McDonald. “They need to get inflation down so they’re playing with Frankenstein. This is a contagion process. They’re now probably going to cut rates by 100 basis points by December.”@Convertbond $SIVB pic.twitter.com/VV3JAm3xtL

— Squawk Box (@SquawkCNBC) March 10, 2023

Larry McDonald told Maria Bartiromo this week that he sees a stock market crash in the next 60 days.

WATCH:

⏰ -30% in 60 DAYS?! MARKET CRASH! ⬇️📉

“HIGHEST PROBABILITY OF A MARKET CRASH IN THE NEXT 60 DAYS!”

“MARKET SHOWS A DROP OF -20% to -30% COMING WITHIN 60 DAYS.”

SAYS LARRY MCDONALD FOUNDER OF ‘THE BEAR TRAPS REPORT”

Can’t help but agree but I’m closer to 90 days. pic.twitter.com/NwoQdYvanE

— Carlos Valadez (Charlie) (@itscharliemar) March 9, 2023