Kim Kardashian agreed to pay more than $1 million in a settlement with the Securities and Exchange Commission for promoting a crypto security without telling those who follow her that she was paid $250,000 to hawk the security.

The case goes back to Kardashian pushing EMAX tokens sold by Ethereum Max on her Instagram account, according to a document filed by the SEC.

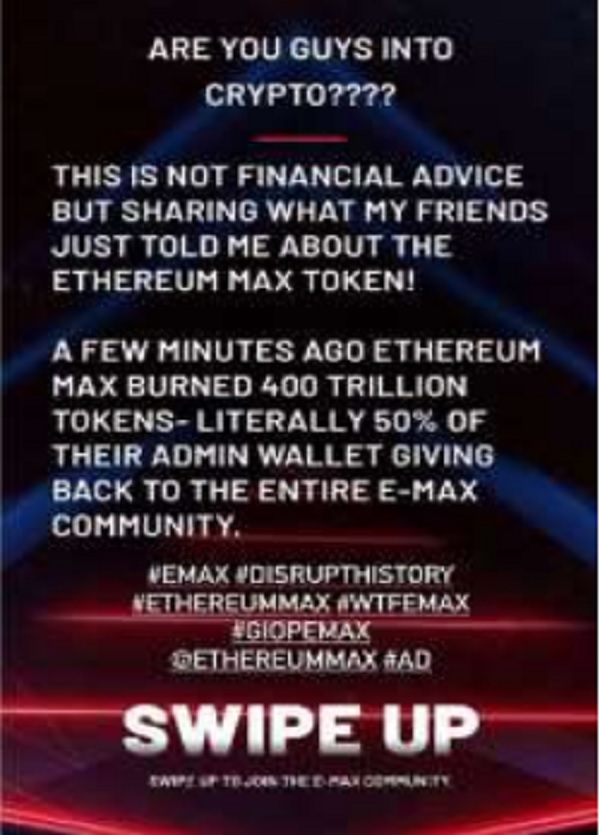

“Are you guys into crypto?” the Instagram post asked. “This is not financial advice but just sharing what my friends told me about the Ethereum Max token.”

The post was published June 13, 2021, the according to the SEC settlement order.

“EthereumMax, through an intermediary, paid Kardashian $250,000 for this promotion,” the order states. “Kardashian did not disclose that she had been paid by EthereumMax or the amount of compensation she received from EthereumMax for making this post. ”

The failure of disclosure “violated Section 17(b) of the Securities Act, which makes it unlawful for any person to promote a security without fully disclosing the receipt and amount of such consideration from an issuer,” the order stated.

The order states Kardashian has to pay $1.26 million to the SEC – the $250,000 she received, about $10,000 in interest, and a $1 million penalty.

Under terms of the order, Kardashian is also banned from hawking any type of crypto security instrument for the next three years.

The order noted that in 2017, the SEC had required celebrities who advertise any kind of virtual currency or security need to disclose how much they were paid to promote it.

In a news release on the SEC’s website, SEC Chair Gary Gensler said fans should be careful when famous people offer financial advice.

“This case is a reminder that, when celebrities or influencers endorse investment opportunities, including crypto asset securities, it doesn’t mean that those investment products are right for all investors,” he said.

Today @SECGov, we charged Kim Kardashian for unlawfully touting a crypto security.

This case is a reminder that, when celebrities / influencers endorse investment opps, including crypto asset securities, it doesn’t mean those investment products are right for all investors.

— Gary Gensler (@GaryGensler) October 3, 2022

“We encourage investors to consider an investment’s potential risks and opportunities in light of their own financial goals,” he said.

“Ms. Kardashian’s case also serves as a reminder to celebrities and others that the law requires them to disclose to the public when and how much they are paid to promote investing in securities,” he said.

A representative of Kardashian said she has fully cooperated with the SEC, according to Axios.

“Ms. Kardashian fully cooperated with the SEC from the very beginning and she remains willing to do whatever she can to assist the SEC in this matter,” the statement said.

“She wanted to get this matter behind her to avoid a protracted dispute. The agreement she reached with the SEC allows her to do that so that she can move forward with her many different business pursuits,” the statement said.

An SEC official said the case is a warning that the SEC’s rules must be followed.

“The federal securities laws are clear that any celebrity or other individual who promotes a crypto asset security must disclose the nature, source, and amount of compensation they received in exchange for the promotion,” Gurbir Grewal, Director of the SEC’s Division of Enforcement, said in the SEC’s release.

“Investors are entitled to know whether the publicity of a security is unbiased, and Ms. Kardashian failed to disclose this information,” Grewal said.

This article appeared originally on The Western Journal.